Hagerty ($HGTY) - Compounding in Classic Cars

Investing in a high quality, durable, long-term compounder business at a reasonable price

“People take good care of their toys.” — Louise Hagerty

As a quick preface, I want to give credit to Kyle Campbell of Greenhaven Road Capital for introducing me to Hagerty. Great investment ideas are very hard to come by, and I've found that having a close network of like-minded investors is the best source of new ideas.

The usual disclaimer applies: this post is not investment advice. Please always do your own due diligence before investing. I own a significant portion of my portfolio in this company and may decide to buy or sell in the future without notice.

Hagerty has all the makings of a wonderful, long-term compounder business. At a high-level, here are the key points to the story:

As a specialty insurer, Hagerty is asset-light and has very low-capital intensity, with its key assets being brand power, proprietary data, and a customer-obsessed organizational culture

Earns very high returns on capital across multiple business segments, each possessing a long growth runway and ample opportunities for reinvestment at 25-30%+ rates of return

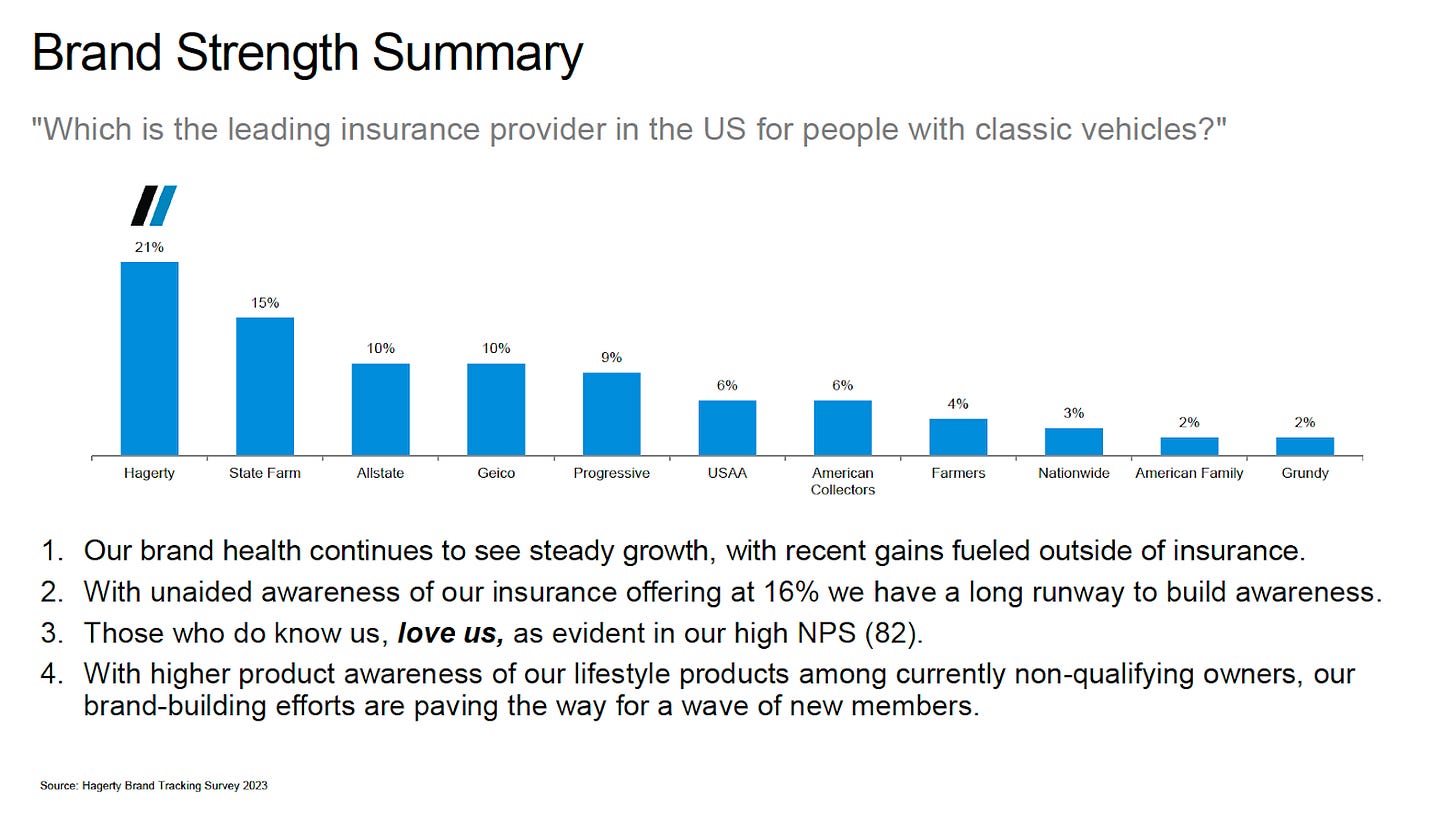

Dominant market leader (5x greater than the closest competitor) in a niche insurance space

Limited to no competition — Hagerty has fostered a cooperative partnership dynamic with 9 of the top 10 auto insurers, effectively neutralizing competitive threats and greatly expanding its growth prospects

Sustainable competitive advantages including superior data, best-in-class customer service, and leading brand power have enabled the company to boast NPS scores double the industry average and extremely low churn (90%+ retention rates)

Owner operator firm led by a second generation CEO with significant skin in the game (founding family controls ~51%, CEO owns ~15%) and a very long-term oriented management team

Shareholder base boasts two large strategic investors that are industry leaders in the insurance space and very sophisticated capital allocators – Markel Corp. and State Farm.

Very under-the-radar and largely underfollowed on Wall Street in part due to SPAC approach of going public and niche focus in insurance

Following years of heavy upfront investment to onboard strategic partnerships, the company is undergoing a rapid inflection in earnings and thus screens poorly on traditional quantitative measures

Company Overview

Hagerty is the leading specialty insurance provider for classic cars and collectible vehicles. Think of insurance for cars ranging from 100-year-old Bugattis that need a crank to start, to beautiful, old-school vintage cars like the 1967 Ford Mustang Shelby GT 500 or the 1969 Porsche 911T, and even more modern sports cars like the 1990s McLaren F1. The underlying focus is insuring cars that are only driven on a limited basis and not used as a daily driver. Though classic and collector cars are by far the largest market and Hagerty’s main bread and butter, the company also insures many other collectible vehicles including wooden boats, motorcycles, antique tractors, vintage camper trailers, and even collector military vehicles.

Side note: Throughout this post, for simplicity, I’ll use “classic car” or “classic vehicle” as catch-all terms to refer to collector cars, vintage cars, antique cars, collectible cars, and any other terms designated for cars that qualify under Hagerty’s scope.

The company was founded in 1984 by Frank and Louise Hagerty as a small insurance agency focused on antique wooden boats. Since inception, Hagerty has grown to become the dominant market leader in the classic car insurance space. In December 2021, the company went public via a SPAC merger that counted two of the most prominent insurers in the world as lead strategic investors – Markel Corp. and State Farm. Markel originally invested $212.5 million back in 2019 for a 25% stake and as part of the SPAC deal, invested another $30 million at $10 per share. State Farm, the largest auto insurance company in the US, led the PIPE deal with a $500 million investment at $10 per share and appointed their CEO at the time, Michael Tipsord, to join Hagerty’s board. It’s worth noting in particular that Hagerty was only State Farm’s second outside investment (first was GAINSCO in 2020) and the largest outside investment in its 100-year history at the time.

Today, Hagerty is still majority-owned (51% ownership) and operated by the founding family. McKeel Hagerty, Frank and Louise’s son, is the CEO and chief architect for the business and has led its rapid growth over the past 24 years.

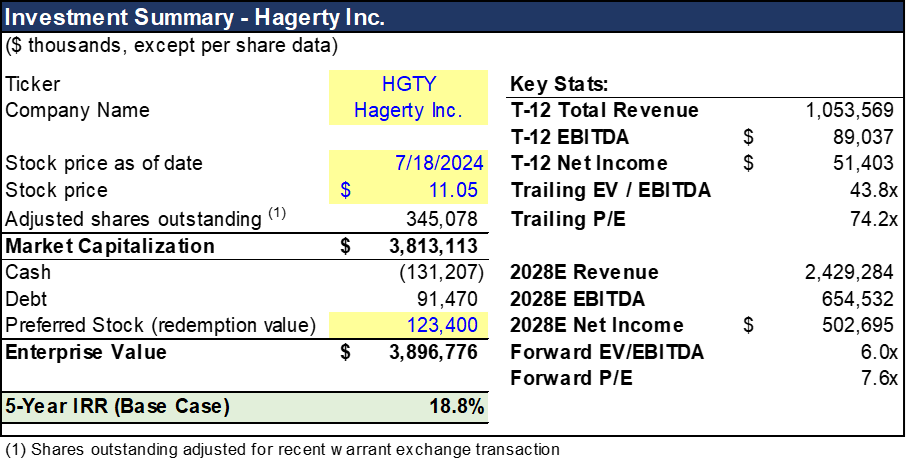

Statistically, Hagerty is not cheap. The company has a market cap of ~$3.8 billion, EV of ~$3.9 billion, and based on trailing-12 month figures currently trades at an EV/EBITDA ratio of 43.6x and a P/E ratio of 73.8x. Here’s a summary snapshot:

As you can tell, it’s not the P/E ratio that attracts me to the company but rather the qualitative factors. Take for example Hagerty’s Net Promoter Score (NPS), a customer loyalty measure that gauges how likely customers are to recommend a company to a friend or colleague. Over the past 5 years, Hagerty has consistently averaged an NPS score of 82, roughly double the auto insurance industry average. For context, anything above 0 is considered good, above 50 is excellent, and above 80 is world-class. Even USAA, who consistently leads the charts in terms of NPS in the auto insurance industry, has a slightly lower average NPS score of 79. Although NPS scores don’t directly translate to investment success, it’s easy to recognize that companies that are better loved by their customers are more likely to outperform their industry peers.

Hagerty’s world-class NPS scores also likely explain their enviable customer retention rates. Over the past decade, the company has maintained an average policy retention rate of ~90%. That is, every year, 90% of policyholders decide to renew their classic car insurance policy with Hagerty. Although this figure is impressive on its own, when you further adjust for vehicle sales (the primary factor in policy attrition is when existing Hagerty customers sell their car), Hagerty’s retention rate is closer to 97%. For comparison, USAA also has a retention rate of ~97% while other giants like State Farm and Progressive are more in the low to mid 80s range. To have close to 90% of your business secured at the beginning of every year is pretty compelling – especially since it gives you a lot more capacity to focus on how to best satisfy your customer and plan for future growth.

The Hagerty Business Model

So what is it about Hagerty’s business that makes it so attractive? The secret sauce lies in the inherent nature of classic cars. As McKeel Hagerty often recounts his mother saying, “People take good care of their toys.” Classic car owners take very good care of their toys because they often hold a special meaning – whether it’s an intense passion and love of cars, a cherished memory of a loved one, or a symbol of status.

Classic car owners also make exceptional insurance customers. They tend to be:

Higher-income/affluent – if you can afford the time and money to own a classic car in addition to your daily driver, you likely have a decent-sized house with a garage and have a greater capacity to spend

Responsible – it takes effort to own and maintain both a classic car and a daily driver

Multi-line insurance customers – classic car owners are more likely to carry multiple insurance products in their household

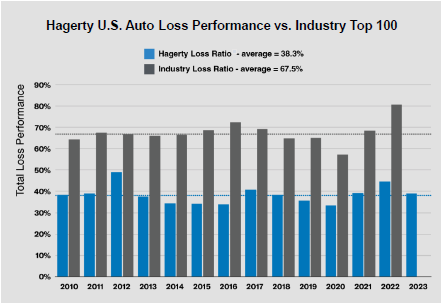

Combine this favorable risk dynamic with disciplined underwriting and you get a pretty powerful recipe for a superior insurance business. The underlying economics of insuring classic cars is drastically different from insuring daily drivers. The evidence manifests itself in Hagerty’s financials with average loss ratios coming in around 38.3% – almost half the industry average.

I’ll break down the business model into what I see as the three key pillars – Insurance, Community & Culture, and Marketplace. Insurance encompasses Hagerty’s Managing General Agency (“MGA”) and Reinsurance segments; Community & Culture encompasses the Membership business (Hagerty Drivers Club, Garage + Social), the media assets (magazine and YouTube), and Hagerty Events; and Marketplace encompasses four distinct components – online auctions, live auctions, private sales, and asset-based lending.

Pillar #1: Insurance

Insurance has historically been the main economic engine for Hagerty and still makes up the overwhelming majority of the company’s total revenues (~90% of total). For most of its history, Hagerty strictly served as an MGA, charging commissions and fees for underwriting, selling, and servicing the insurance policies. In this capacity, the company managed virtually all primary facets of the insurance process, including designing the policy structure, underwriting the risk, pricing the premium, selling and distributing insurance products, collecting the premium, and handling all corresponding claims. The actual financial burden in the event of loss was fully assumed by the carrier partners that work with Hagerty – in the US and the UK, the risk partner is Markel, while in Canada, it’s Aviva.

In 2017, Hagerty formed its reinsurance business, Hagerty Re. Hagerty Re entered into quota share reinsurance agreements with its carrier partners, whereby a certain % of the premium volume would flow back to Hagerty Re each year, enabling the company to assume risk and ultimately capture a portion of the consistent underwriting profits. The quota share began at 25% for the US market in 2017 and has gradually stepped up to 80% in 2023. As a result, earned premium from Hagerty Re has quickly eclipsed MGA commissions and fees to become the largest component of total revenue (~54% of total).

To fully appreciate the attractiveness of the MGA business, and by extension the Reinsurance segment, it helps to drill down to the unit economics of a Hagerty insurance policy:

I’ve borrowed this slide from Hagerty’s Q4 2021 roadshow presentation to help illustrate (though it’s a bit dated, the model is still applicable). Using $300 as a base figure for the average premium on a single vehicle, starting from the bottom we see that the first $123 (41%) of the premium gets paid out to policyholders by the carrier for claims losses. Next, we have $147 (49% of the premium) allocated towards all the expenses required to administer the policy, the majority of which (42%) goes to Hagerty in the form of commissions and fees in its capacity as the MGA and the remainder (7%) going to the carrier to help offset certain G&A expenses. The 42% commission piece is technically further broken down into 2 layers – 32% base commission and 10% contingent underwriting commission (“CUC”), which gets paid out as long as loss ratios stay within an acceptable range. The CUC has averaged 9.75% per year since 2010, indicating that most of the contingent opportunity gets paid out due to the stable loss ratios. Lastly, the remaining $30 (10% of the premium) gets pocketed as underwriting profit, 80% of which now also goes to Hagerty through its reinsurance operations, Hagerty Re. All in all, roughly 50% of the total policy premium ultimately accrues to Hagerty.

For context, here’s how Hagerty’s insurance model compares to the average auto insurance company:

As you can begin to see, Hagerty’s insurance business is very compelling. On one hand, you have the MGA, which is a highly predictable, recurring revenue, and very sticky fee business that generates steady-state operating margins in the mid- to potentially high-teens range. On the other hand, you have a reinsurance business that pairs beautifully with the MGA by capturing the consistent underwriting profits generated by the MGA’s effective underwriting year in and year out.

In fact, the story gets even better with Hagerty Re. From the 8% of the premium that Hagerty pockets as underwriting profit through Hagerty Re (as discussed above), Hagerty Re earns an 11% operating margin. The math works out as follows: similar to the illustrative example discussed above, for every dollar of premium that flows to Hagerty Re, 41% gets paid out as loss claims, 42% accrues to Hagerty MGA for underwriting and administering the policy, 6-7% is overhead expenses and reinsurance costs, leaving 10-11% in operating profit. The icing on the cake is that for every dollar retained in Hagerty Re’s business, it can write $3-4 in premiums (based on regulatory capital requirements). So as an example, if $10 of operating profit is retained in a given year, Hagerty Re can write $30 of premiums the next year and earn $3 of operating profit – resulting in an incremental return on retained earnings of 30% ($3 of operating profit divided $10 of retained capital). Where else can you consistently earn 30-40% yields on capital?

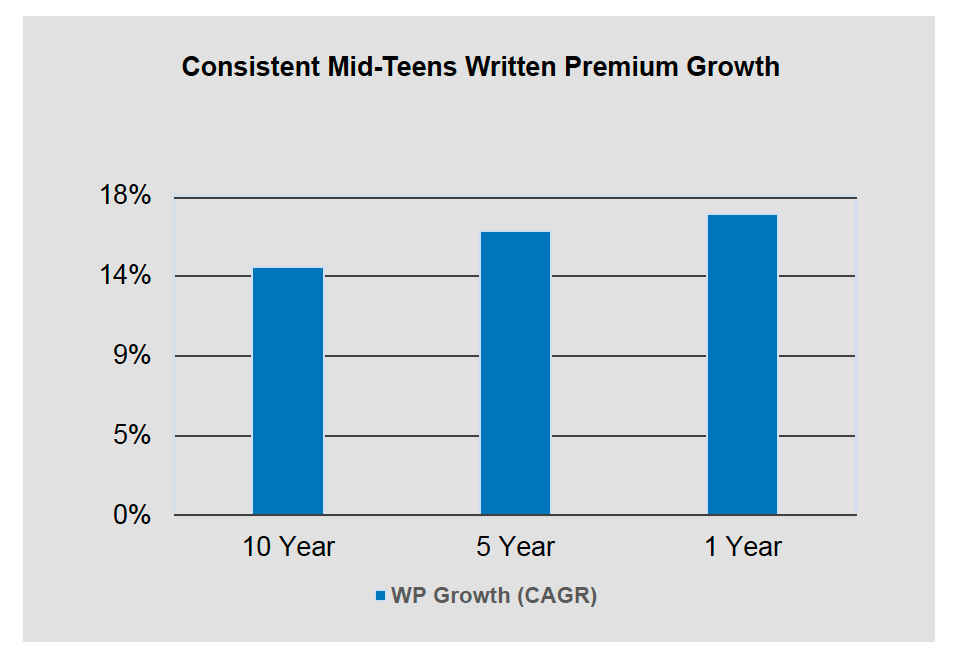

As for growth and future opportunity, the classic car market is much bigger than you might think. Hagerty estimates the overall TAM to be ~$12-15B, comprising ~46.3 million collectible vehicles. (By the way, this TAM is a much more reliable figure than other TAM figures as Hagerty has a comprehensive proprietary database that closely tracks all the vehicles in the market.) The TAM is also continually growing as collectible car values tend to appreciate over time, newer cars (ex. 1990s generation) age into the category, and new modern classic cars are produced. And when it comes to historical growth, Hagerty has consistently grown in the mid-teens range for over 2 decades, more than triple the average annual growth experienced by the top 100 firms in the auto insurance industry. And with Hagerty’s market penetration at only 4% today, the runway for growth is still very long.

Before we move on to the second key pillar of Hagerty’s business model, it’s worth highlighting the underlying source of Hagerty’s deep competitive advantages. What’s stopping a better capitalized competitor from entering the market and weakening Hagerty’s dominant position? The answer lies in two elements: classic car valuation data and customer service.

In a fireside chat with Scott Miller of Greenhaven Road Capital, McKeel Hagerty shared the following insight: “The best businesses control the intellectual high ground of their space; the intellectual high ground in the classic car insurance space is what a car is worth.” To achieve the intellectual high ground in their space, in the early 2000s, Hagerty set out to build the most extensive database of classic car values. An interesting dynamic about classic cars is that before 1981, there was no standard format for vehicle identification numbers (VINs). Different manufacturers and even divisions within a manufacturer used different formats. VINs from before 1981 ranged from 5 to 13 digits whereas post-1981, the format was standardized to the current 17-character format.

So in order to build the database, Hagerty acquired massive datasets and hired a team of data scientists to analyze and decode the complex information. Through all this effort, Hagerty managed to create a patented VIN decoder to accurately decipher all the data and successfully build the most comprehensive database of classic car values in the industry. Today, Hagerty’s valuation tool is the industry’s go-to resource for all classic car valuation data (think KBB for classic cars) and is not only used by consumers but also by competitor firms.

The net result is this unassailable data advantage enables Hagerty to consistently underwrite policies more accurately than its competitors.

With respect to customer service, the core advantage stems from the company’s intrinsic culture of love and passion for cars. The culture is ingrained from the very top – McKeel bought his first car, a 1967 Porsche 911S, when he was 13 for $500 and restored it with his dad over a few years. Hagerty is filled with such car enthusiasts and experts who love cars and want to nurture the classic car world. As a result, this shared passion filters through in their interactions with customers.

The company goes to great lengths to take care of its customers. As an example, Hagerty has an extensive relationship network with expert repair auto shops across the US. In addition, it also has a dedicated in-house specialty parts team that is focused on sourcing hard-to-find parts for these partner auto shops and insurance customers. Hagerty even has a program to support and compensate policyholders that prefer to fix the cars themselves, paying a certain hourly rate for personal labor and compensation for new auto parts. In fact, another interesting dynamic is car owners will typically make a claim only in the event of a total loss. Why? Because an $80k claim on a $3M car might see its value drop by $500k - $1M. All these elements help explain how Hagerty is able to limit claims costs and consistently maintain such low loss ratios.

Bringing the two key advantages together (better data + customer service), it becomes clear why Hagerty commands such a dominant position in the market. It’s 5x larger than the next closest competitor in terms of written premiums. It has also secured key partnerships with 9 of the top 10 auto insurers in the country. This is one of the most important points to grasp about Hagerty’s moat – they virtually have no competition within the classic car insurance market. For the top insurers, the benefits from partnering with Hagerty are twofold:

Underwriting and servicing a classic car policy is very complex. To illustrate the complexity, McKeel likes to use the example of the 1969 Chevy Camaro. The 1969 Chevy Camaro is one of the most collected and most attractive of all vintage Camaros. In that year, they made 147 different variants of a 1969 Camaro and the least valuable is worth ~$11k while the most valuable is worth ~$1.1 million. Given the huge disparity, it’s crucial to know which variant one is insuring and the only player that can reliably do so is Hagerty.

Partnering with Hagerty is an effective way to poach business from non-partners. Oftentimes, many classic car owners unknowingly take out a regular auto policy for their classic cars. Since Hagerty’s policy is typically 30%+ cheaper than a regular policy on a given vehicle, partners like State Farm, Allstate, and Progressive can hunt for these customer profiles within other non-partner insurers and offer better coverages at a lower combined price. Another point to remember is that classic cars are only a small portion (~10%) of the overall household premium as classic car owners tend to be multi-line insurance customers. And since Hagerty is exclusively focused on classic cars, they don’t have any channel conflict in other insurance lines. So not only do the partners get a commission from Hagerty for sourcing the new business, but they also benefit from the substantially larger overall premium acquired as a whole.

Pillar #2: Community & Culture

The second major leg of the stool, what I’ve termed as Community & Culture, includes Hagerty Drivers Club (“HDC”), Garage + Social, and Hagerty Media and Entertainment (HDC magazine, YouTube, car events). This is one of the most interesting facets to the story and a key driving force for Hagerty’s success.

When we study great business stories, we often learn about defining moments that transform a company’s future trajectory. Hagerty’s moment came when McKeel, while sitting in class for his doctoral program in ancient philosophy, had the unique insight that “by treating Hagerty as a membership club rather than an insurance company, they could unlock tremendous value.” As the story goes, he actually left the classroom right then and there and moved back to Michigan to pursue the idea within the family business.

This crucial idea – that as long as you focus on building and supporting the community and classic car lifestyle, the insurance piece takes care of itself – is what truly differentiates the company and is a key source of customer captivity.

The strategy begins with Hagerty Drivers Club, the world’s largest membership program for car enthusiasts. HDC echoes many of the great membership programs (Costco, Amazon Prime, and REI) in fostering customer loyalty. For a $70 annual fee, members get six issues of HDC magazine, access to online shows and interviews, exclusive discounts to automotive offers (car parts, events, merchandise), 24/7 flatbed towing service, unlimited listings to Hagerty Marketplace (more on this later), support from Hagerty’s in-house experts, and unlimited vehicle lookups with Hagerty Valuation Tools.

The next layer is Hagerty Media and Entertainment. The HDC magazine is the world’s second largest automotive magazine by audited circulation that provides car enthusiasts all of the latest stories, content, and trends on the industry. Hagerty also has a fast-growing YouTube channel that has over 3.2 million subscribers and features many prominent influencers like Jay Leno and industry journalists like Jason Cammisa. And when it comes to events, Hagerty not only owns and operates some of the most popular car shows (Amelia, Greenwich Concours, RADwood etc.), but also sends employees to thousands of shows every year, constantly building awareness of the company brand. The best part of it all? The word “insurance” is never mentioned even once across all these avenues.

The intent for building this integrated portfolio of membership, media, and entertainment assets roots back to the company’s core purpose – to save driving and car culture for future generations. The benefit from a business standpoint is that the revenue streams and data collection opportunities from all these different customer touchpoints have produced a highly efficient and effective self-funding marketing machine. Think about all the data that Hagerty is able to gather from all these channels to build robust customer profiles and constantly fine-tune their risk models. As a result, Hagerty enjoys the best word-of-mouth marketing in the entire industry.

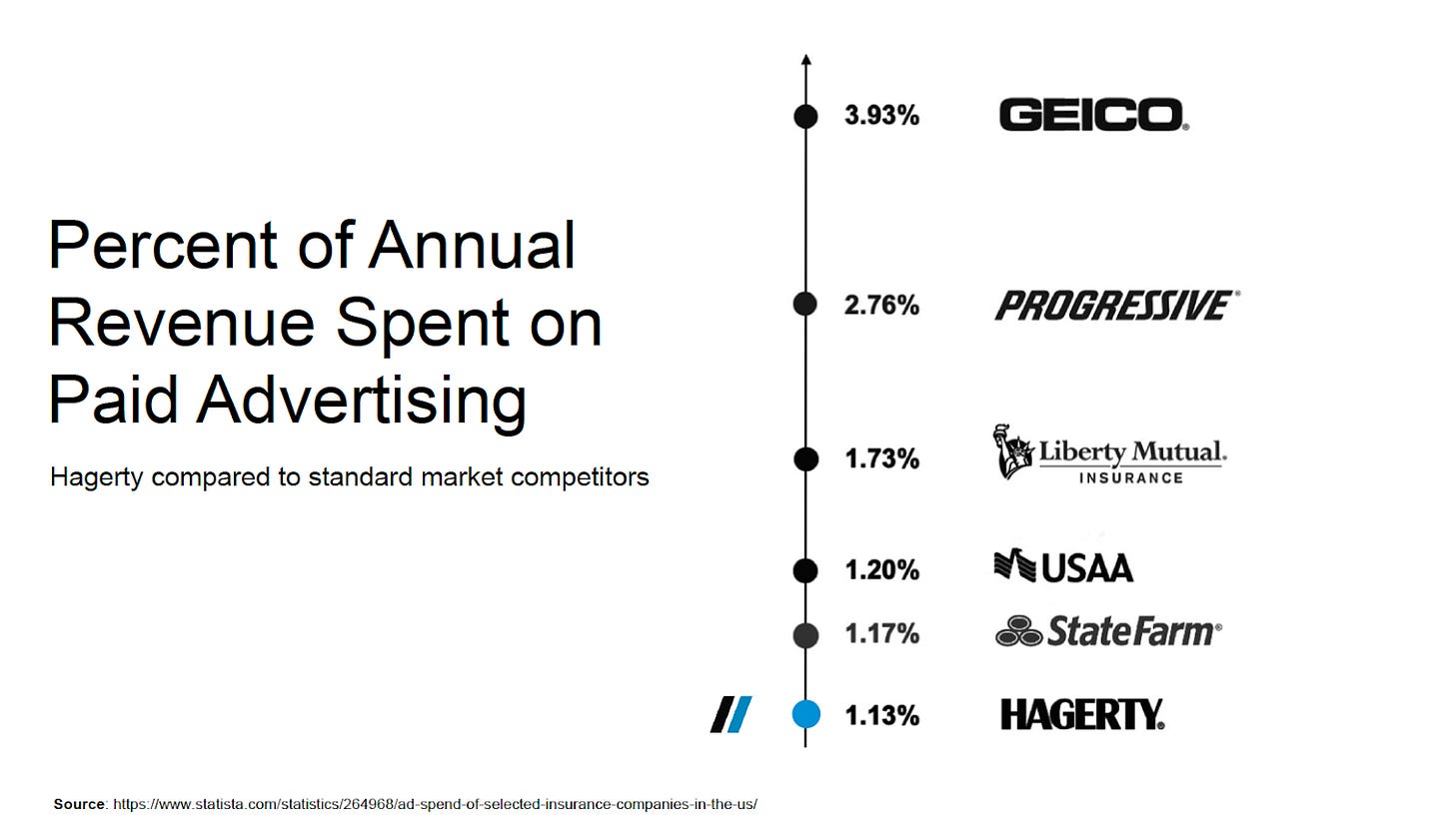

The proof is in the pudding. Hagerty’s customer acquisition costs are less than half the industry average:

The company spends less on paid advertising as a % of revenue than all the top insurance brands in the US:

And Hagerty’s brand strength also leads the rest of the field…

Pillar #3: Marketplace

The third and final pillar of the company’s business model is the Marketplace segment. This segment is focused on helping classic car owners buy, sell, and finance their vehicles. For buying and selling, there are 4 key channels: Live Auctions, Private Sales, Online Auctions, and Classifieds.

Live Auctions and Private Sales generally constitute the high-end of the classic car market, where car values exceed $100,000. In addition to other auction events, Hagerty is able to host live auctions through five of its fully-owned auto events (all acquired between 2019 and 2021):

Amelia Island Concours d’Elegance (Amelia Island, FL; considered the second most prestigious car show in the US after Pebble Beach Concours)

Greenwich Concours d’Elegance (Greenwich, CT)

Concours d’Elegance of America (Detroit, MI)

California Mille (1,000 mile car tour through the hills of Northern and Central California starting in San Francisco)

Motorlux (3-day auction in Monterey, CA)

At the other end of the market, we have time-based Online Auctions and Classified Listings, which get transacted on Hagerty’s Online Marketplace. Though some cars sold online have transacted for hundreds of thousands, and in some rare cases in the millions, the overwhelming majority transact below $100,000 with the average closer to ~$50,000 (generally speaking that is — Hagerty’s platform is still ramping up so average sale price is lower than this.)

The underlying economics for the Marketplace business are fairly straightforward. As the auctioneer and platform owner, Hagerty takes a cut of the car’s sale value. The take rates are as follows across the segments:

Live Auctions – typically 10-12% buyer’s premium and 0-10% seller’s premium; the more premium the car, the lower the seller’s premium.

Private Sales – typically 5-10% buyer’s premium.

Online Auctions – 7% buyer’s premium.

Classifieds – free to list for HDC members and no buyer’s premium.

Given the low capital intensity, the stabilized operating margins for Marketplace are highly attractive. Live Auction operating margins should range between 25-40%, depending on the auction and venue, while Private Sales and Online Auctions (at scale) can generate anywhere from 50% to 70% operating margins.

What may come as a surprise to many readers is that the classic car transaction market is quite sizable. According to company estimates, for 2022, the total transaction value of classic and modern collectible cars was over $105 billion, of which ~$100 billion came from private sales, and the remainder somewhat split between live and online auctions. Given the confidential nature of private sales, the $100bn figure should be taken with a grain of salt. However, what we do know with a greater level of confidence is that of the $105 billion total, Hagerty saw ~$12.5 billion of transactions from its insurance book alone in 2022. In 2023, that number grew to ~$14 billion across ~300,000 cars.

If we simply assume that Hagerty manages to capture just 20% of the transaction volume flowing through its insurance book, and an average buyer’s premium of 10%, Hagerty would generate $280 million in incremental revenue and potentially over $140 million in operating profit. Given that total EBITDA (for the whole company, not just Marketplace) for the past 12 months was ~$110 million, it’s clear that Hagerty has a lot of opportunity ahead of it.

Unlike the insurance business, Hagerty’s Marketplace business has more competition. There are a number of established players – ranging from RM Sotheby’s, Mecum, Barrett-Jackson and Gooding & Co. on the live auctions and private sales side to Bring-a-Trailer, Cars & Bids, eBay, Facebook Marketplace, and many others on the online marketplace side.

That being said, as the preeminent brand in the car enthusiast world, Hagerty is entering the market from a position of strength. The key differentiating factor that sets Hagerty apart from its competitors is its special focus on trust. Insurance brings trust – trust that the company will pay out any claims when disaster hits. Hagerty Valuation Tools brings another element of trust – trust that the car values for vehicles are derived impartially and supported by concrete data from past and current trends. And when it comes to Marketplace, Hagerty is looking to bring a higher level of trust and transparency that has been historically lacking in the industry – one that not only protects the interests of the sellers but also those of the buyers.

In addition to monetizing the existing customer base, the Marketplace business also provides an opportunity to boost insurance revenues in two ways – 1) acquiring new customers at the moment of purchase and 2) improving retention by keeping existing Hagerty-insured vehicles within the ecosystem upon sale. Remember, the number one reason for insurance policyholder attrition is an existing customer selling their single policy vehicle. As the marketplace business scales, we should gradually see an improvement in the average policy retention rates.

An important point to note about the leadership team behind Hagerty Marketplace (acquired as part of the Broad Arrow Group (“BAG”) acquisition) is that much of the management team, led by Kenneth Ahn, originally oversaw the live auction and private sales business at RM Sotheby’s. Before they left to start Broad Arrow Group in 2021, they had built up Sotheby’s business to ~$900MM in total GMV (gross merchandise value). With BAG now a part of Hagerty, and Ken leading the Marketplace business, the company is very well-positioned to benefit from the team’s deep expertise of the classic car marketplace and long-established relationships with large collection owners in the industry.

The last piece worth mentioning about the Marketplace segment is the asset-based lending or vehicle financing business. In this business, Hagerty extends bridge financing and term loans secured by the classic cars to large buyers (primarily high-net-worth individuals and collection owners). Naturally, this business is also advantaged as it can leverage Hagerty’s superior data to mitigate credit risk from fluctuations in underlying collateral values. Although it’s hard to gauge how large this business could become, from what I’ve learned, Ken and Patrick McClymont, Hagerty’s CFO, built a $1 billion loan book from the ground up at RM Sotheby’s in the past. Given Hagerty’s present loan book of ~$61 million, there is a lot of room for future growth. The business will also generate an attractive return on equity as Hagerty typically borrows roughly 50% of the loan, thereby capturing an interest rate spread.

Valuation

Now that we’ve covered the key aspects of the business, let’s talk about valuation. In my base case scenario, using the current price of ~$11 per share, I’m projecting a 5-year IRR of 19% and an approximate return on investment of 2.4x. I’m using an exit multiple of 20x on 2028 Net Income, which seems reasonable for a high quality business that will continue to grow in the mid-to-high teens range for the foreseeable future.

Although Hagerty looks expensive based on TTM earnings, there are a number of key catalysts in play that will drive a rapid inflection in earnings over the next 3 to 5 years. Consider the following:

Over the past several years (mostly 2021 through early 2023), Hagerty made significant upfront investments in technology systems and people to 1) onboard the State Farm partnership business and 2) to stand up the Hagerty online marketplace

Earnings were significantly depressed in 2021 and 2022 as the company incurred all these large non-recurring expenses (~$60m) but received no revenue from them

As part of the SPAC deal, Hagerty entered into a 10-year strategic partnership with State Farm, which entailed rolling over an initial 480,000+ of State Farm classic car policies and actively engaging State Farm’s 19,200 agents to write new policies

The State Farm opportunity is sizable – with Hagerty having ~1.4m policies in force at the end of 2023, just the initial 480,000 policies would represent over a third of the company’s total insurance book; my understanding is there’s potentially another ~1 million policies that can be captured from State Farm’s policy base over time

A point of note is State Farm will retain the risk associated with these policies so Hagerty will only receive MGA commissions and fees and HDC membership revenue (no reinsurance profits)

In addition to State Farm, there are a number of other potential new partnerships in the pipeline including:

Potential partnership with 1 or 2 HNW insurers (Chubb, AIG, etc.)

Potential partnership with GEICO (the only insurer in the top 10 that Hagerty doesn’t have a partnership with currently; although there has been no indication yet, a potential partnership shouldn’t be ruled out completely)

Beyond the significant growth in policies and premiums from new partnerships, it’s important to highlight that Hagerty’s existing partnerships with 9 of the top 10 auto insurers also offer a significant source of ongoing growth

Hagerty’s penetration within these partner’s customer bases is still relatively low as it takes time to convert independent agents and customer policies over to Hagerty

Many top auto insurers work with independent agents who do not have to use Hagerty despite the partnership. So part of the ongoing effort is to build awareness with agents that Hagerty’s policy is superior to a partner’s offering and will be in the best interest for all parties involved

This channel has consistently delivered low-to-mid teens revenue growth historically and should continue to do so as Hagerty continues to increase market share within partners’ customer bases

Lastly, the outsized growth in policies should also drive a significant corresponding increase in HDC memberships. Historically, Hagerty has experienced a ~75% HDC adoption rate for new insurance policies.

Taking into account all these growth vectors, as a base case, Hagerty should be able to grow MGA commissions and fees at a 22% CAGR and earned premium at a 17% CAGR over the next 5 years, both driven by a written premium CAGR of 22%. HDC Membership revenue will also benefit from the large growth in the number of policies and should grow at a 5-year CAGR of 21%. For operating margins, the MGA business is projected to return to a mid-teens operating margin over time (consistent with historical experience prior to heavy investment period) and, assuming loss ratios average ~41% over the long-term, the reinsurance business should generate ~10% operating margins for the foreseeable future.

The tough part in estimating Hagerty’s value is trying to forecast the future growth trajectory for the Marketplace business. First off, the Live Auctions and Private Sales side of Marketplace is a very relationship-based business. What ultimately drives success in these segments is having the right team of car specialists that get consignments through long-established relationships with large car collection owners and high net worth clients. Fortunately, Hagerty benefits greatly by having Broad Arrow Group lead this part of the business as the team is filled with industry veterans and specialists with extensive client networks. Since launching in Q1 2022, Live Auctions has been off to the races – GMV was $86.8M in 2022, $108.5M in 2023, and $138.7M for year-to-date 2024. Based on conversations with other Hagerty investors, I’ve heard that Private Sales GMV was ~$120M in 2023. These figures compare well with 2022 stats for RM Sotheby’s (the largest player in auctions) of ~$590M in Live Auctions and $275M in Private Sales, especially considering that Broad Arrow Group has only been in business for just over 2 years.

Given the difficulty in predicting the volume and scale of future auctions and private sales, to be conservative, I’ve projected a 25% Revenue CAGR for Live Auctions over the next 5 years and a 10% Revenue CAGR for Private Sales, resulting in 2028 GMV of $331M for Live Auctions and $193M for Private Sales. This seems fairly reasonable to me considering that in 2022, RM Sotheby’s achieved $586M GMV for Live Auctions and $275M GMV for Private Sales.

The biggest and by far most attractive opportunity for the Marketplace segment lies in Hagerty’s Online Marketplace. To get a sense of what Hagerty’s platform could become, we don’t need to look much further than Bring-a-Trailer (BaT), the largest online platform for collector cars. Launched in 2014, BaT’s GMV started from a base of $6.8M in 2014 and roughly doubled every year for the first 5 years ending 2019 with $248M in sales. Unsurprisingly, COVID saw accelerated adoption in online auctions as live auctions ground to a halt – GMV continued to grow at a rapid clip reaching $412M in 2020, $859M in 2021, $1.35B in 2022 and finally $1.4B in 2023.

In comparison, Hagerty launched Online Marketplace in November 2022 and in its first full year in 2023, the platform generated ~$17M of GMV. Developed entirely in-house, the platform is being ramped up very gradually – digital teams are adding new features to the platform every 2 weeks – to ensure listings have a robust balance of demand and supply and attractive sell-through rates. For modeling purposes, I’ve assumed in my base case that Hagerty would follow a similar growth trajectory for its first 5 years as BaT: doubling GMV every year to end 2028 with ~$525M in GMV. This would generate ~$37M in revenue at a 7% take rate and an operating profit of $22-25M. This may end up being very conservative as it implies only 44 cars sold per calendar day, a sell-through rate of 85%, and an average sale value of $39k, compared to BaT’s current levels of ~80 cars sold per day at an average sale value of $47k.

The final major component to Hagerty’s value is the vehicle financing business. Similar to Live Auctions and Private Sales, this component is very difficult to project out but seeing as Patrick and Ken were able to build a ~$1 billion loan book at RM Sotheby’s, I’ve conservatively assumed that Hagerty’s loan book would grow to ~$285M by 2028, reflecting a CAGR of 40% over 5 years.

Risks

Catastrophe Risk: Although Hagerty has built up a sizable cash reserve ($521M as of Q1 2024) and has catastrophe reinsurance in place to limit overall risk exposure, a series of catastrophic events would certainly impact the future earnings power for the reinsurance segment, especially if they all fell under the reinsurance threshold per event ($25M) . As an example, a hurricane season with five events of $20M in losses each would hurt Hagerty more than one big $100M loss event as the outside reinsurance would only cover any losses in excess of $25M per event.

New Business Risk: Hagerty is currently launching new products and service offerings to expand further into the fast-growing post-1980 Enthusiast vehicles segment. Risk profiles for this segment may be less attractive than the pre-1980s vehicles resulting in higher loss ratios going forward.

Key Person Risk: McKeel Hagerty remains as the key visionary, chief decision maker, and champion of the culture for the company. If anything unfortunate were to happen to him, the company would certainly be negatively impacted. This risk has been somewhat mitigated over the years as the company has deepened the management bench significantly with a number of key hires – new COO and CIO Jeff Briglia, new CFO Patrick McClymont, Broad Arrow Group team.

Low Float Risk: More of an investment risk than a business risk. The company currently has a very small free float – roughly 14 million shares after netting out large strategic investors, passive funds, and long-term oriented active managers. The recent warrant exchange transaction has helped expand the float by ~3.9M shares and based on recent conversations, Rob Kauffman (SPAC sponsor) is also selling down his 6.2 million shares as part of a share sale plan. As the stock appreciates in value, it’s also likely that Goldman Sachs will sell down Kim Hagerty’s position (~44.4M shares) as part of its fiduciary responsibility to the estate beneficiaries.

Closing Thoughts

Hagerty is a good example of a business that I wouldn’t mind owning if markets suddenly closed for the next 10 years. It’s so rare to find such a high quality business that is so under the radar and underfollowed by the general investing populace. When you own a business that sells a government-mandated product (you can’t drive your car without insurance), has an extremely sticky customer base (90% retention rate and 80+ NPS scores), enjoys sustainable advantages with virtually no competition, earns high returns on capital, has a potentially multi-decade growth runway, and most importantly, is run by an aligned and laser-focused management team, not much has to go right to achieve a superior investment return.

Additional Resources

For those interested in further research into Hagerty, here are a few helpful resources:

Great read Tuan, very comprehensive write up of a quality business!

excellent writeup Tuan.

Any comment on their Class A/Class V share structure? I can't wrap my head around the portion of income that is attributable to NCI. I thought the ratio between income for ClassA/income attributable to NCI should stay statble, but this does not seem to be the case. Do you think Class A holders are getting short changed here?