2025 Year-End Reflection

A comprehensive review of my 7-year journey and current portfolio positioning

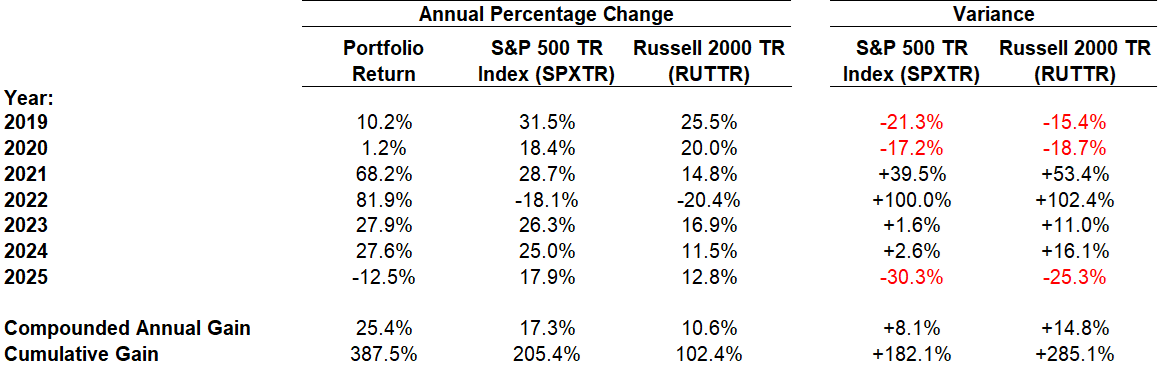

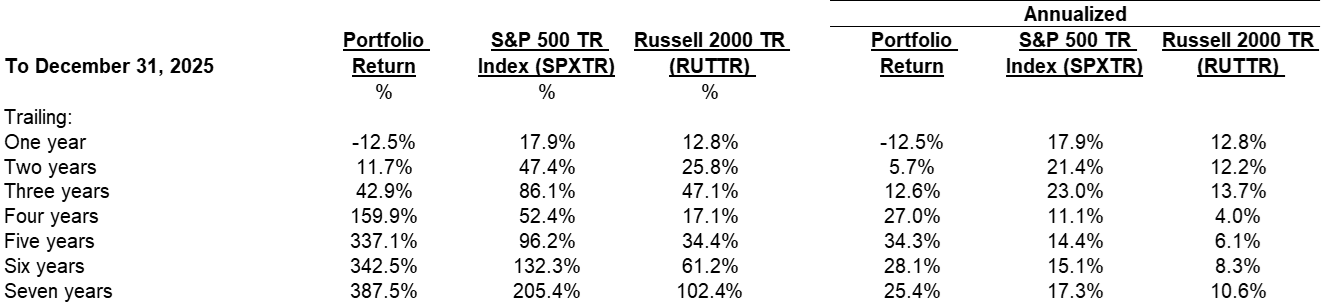

The portfolio has taken a step back in 2025. For the 12 months ending December 31, 2025, the portfolio declined 12.5%, underperforming the S&P 500 by 30 percentage points and the Russell 2000 by 25 percentage points. Due to this year’s decline, the rolling 3-year record has now dipped below the benchmarks - with the portfolio compounding at ~13% over the past 3 years versus 23% for the S&P and ~14% for the Russell 2000 (including dividends).

On a 5-year rolling basis and since inception (7 years), the results remain quite satisfactory. However, with each passing year, I increasingly discount the strong returns in 2021 and 2022, realizing that those gains involved considerable luck and corresponding portfolio risk. That said, my philosophy has always emphasized business risk over volatility, which I, for better or worse, judged to be relatively low at the time.

At any rate, it’s both humbling and gratifying to see the evolution of the portfolio and my investment process over the years. In the early years - call it 2019 through 2022 - I had some semblance of an investment process, but it was pretty weak. I conducted no primary research, had a limited analytical toolkit, employed no probabilistic valuation approach, and had limited understanding of portfolio management. I primarily borrowed conviction and rode the coattails of other more experienced investors as I learned the craft and navigated the markets.

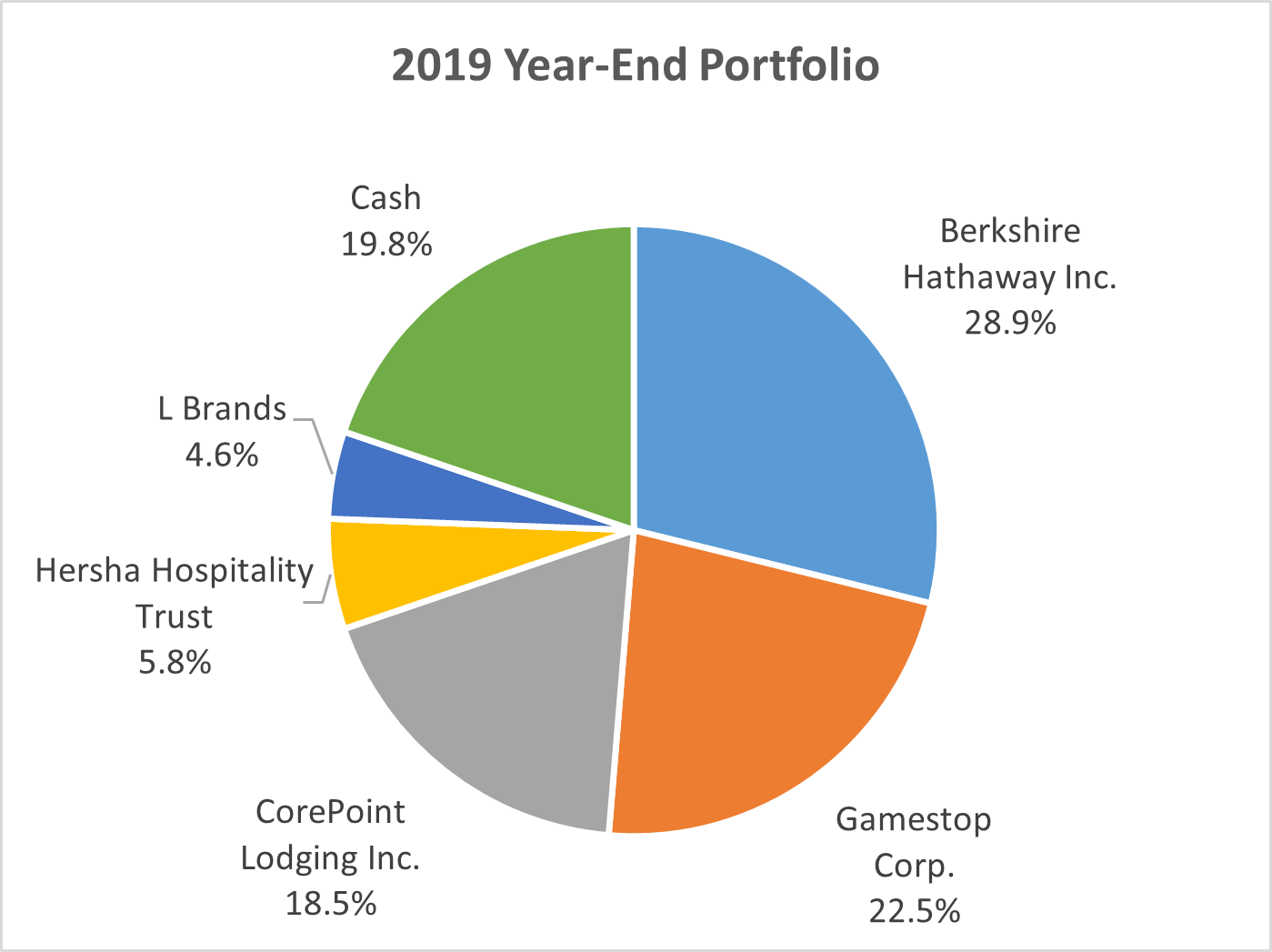

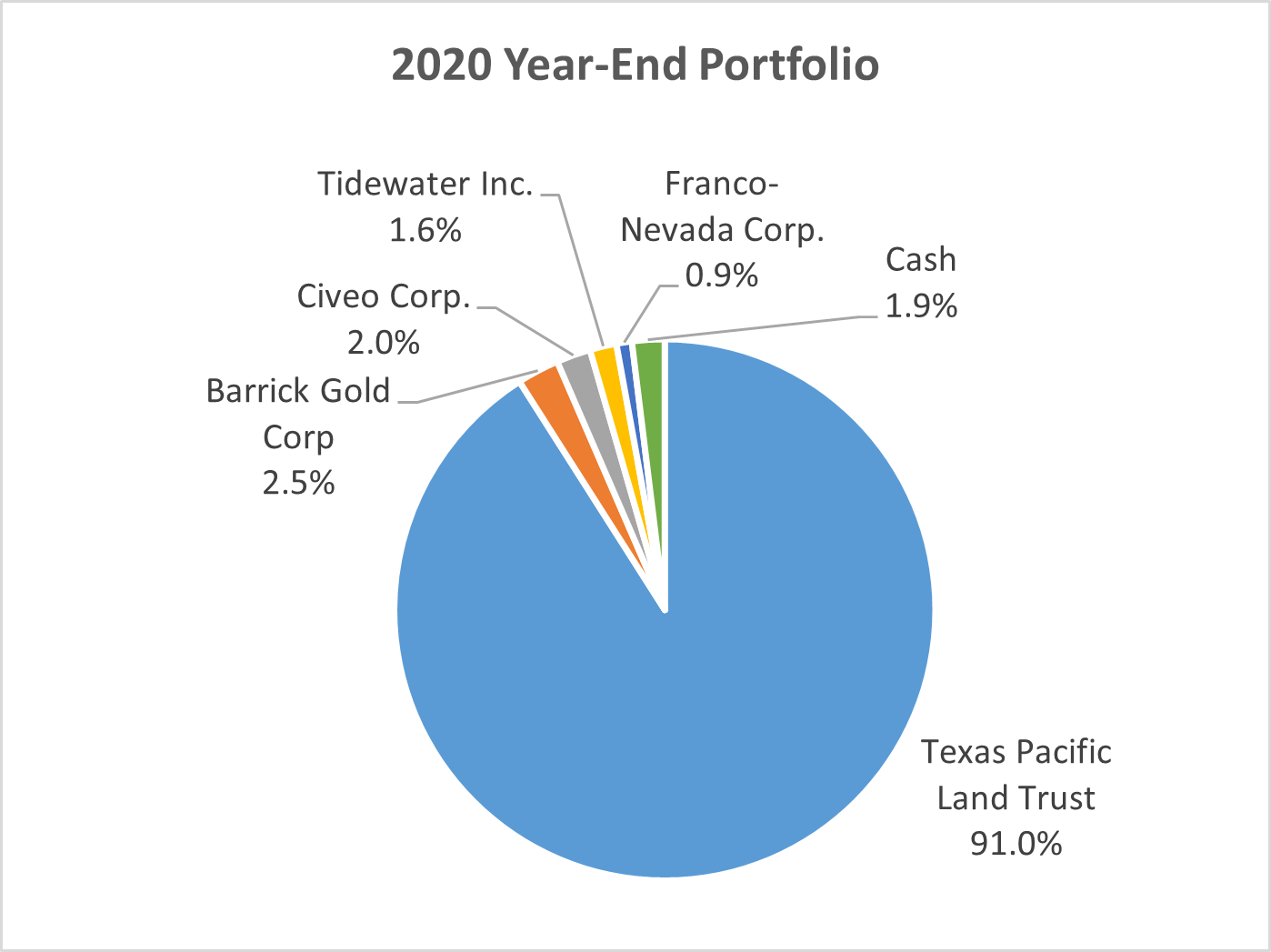

What I did have, however, was the right philosophy and framework for thinking about markets and investing. Having embraced value investing and closely studied Ben Graham, Buffett, and Nick Sleep in prior years, I developed the intuition not only to avoid the rampant speculative mania, but also to follow and borrow conviction from the “right” people. I also gained a deeper appreciation for the futility of market timing - after selling out of positions in early 2020 on predictions of economic Armageddon, only to miss the massive rally that ensued (including Gamestop). That experience taught me the critical importance of patience and concentration in investing, which in turn enabled me to hold TPL through both 2021 and 2022 and capture its significant returns during that period.

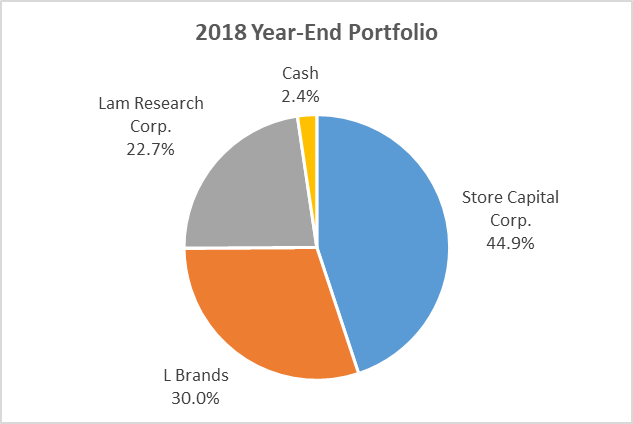

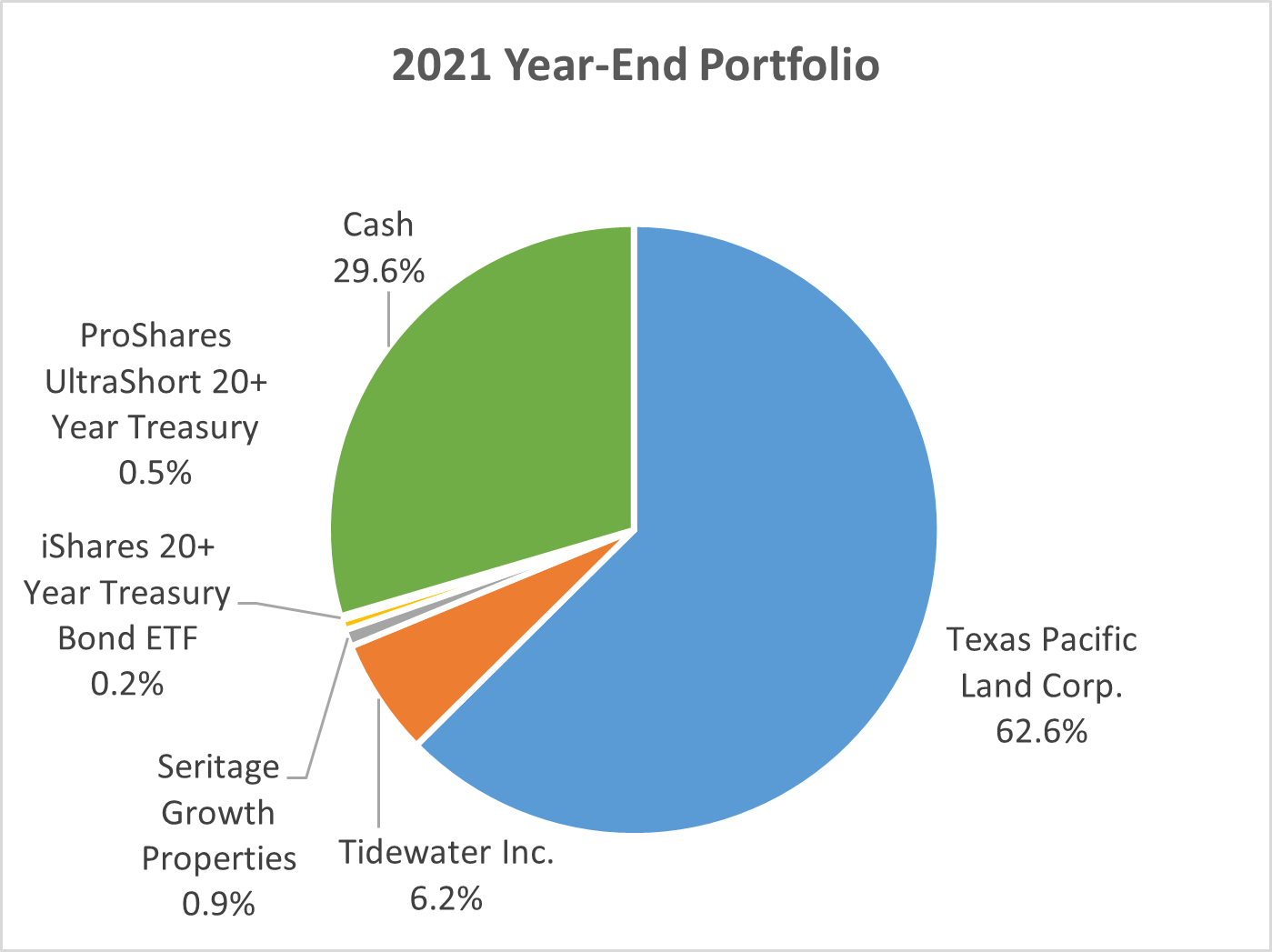

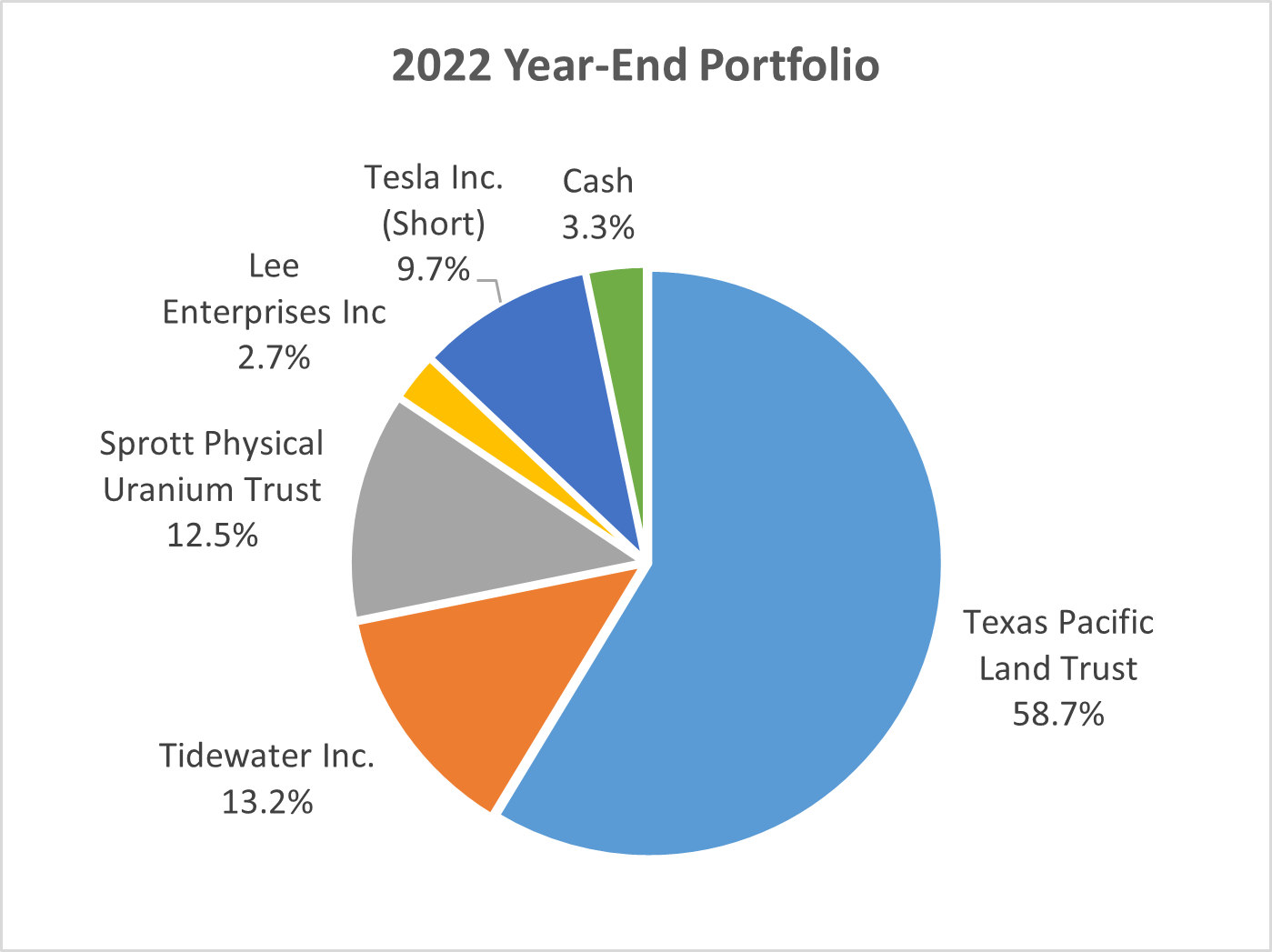

To illustrate the evolution, here’s a snapshot of year-end allocations from 2019 to 2022 (% based on total portfolio value at market):

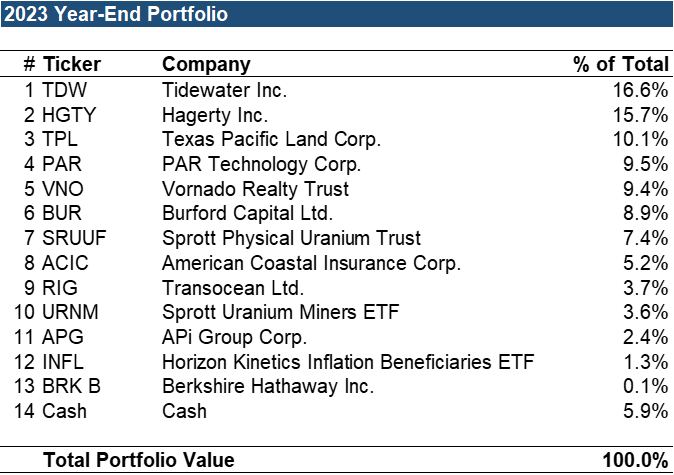

Beginning in 2023, as I refined my process and approach to portfolio management, I grew increasingly concerned about my heavy exposure to a single stock. At the same time, I began to see compelling value in other areas of the market. As a result, I significantly reduced my position in TPL and redeployed the capital into a more balanced group of businesses, spanning insurance (HGTY, ACIC), litigation finance (BUR), commercial real estate (VNO), restaurant enterprise software (PAR), and industrials (APG).

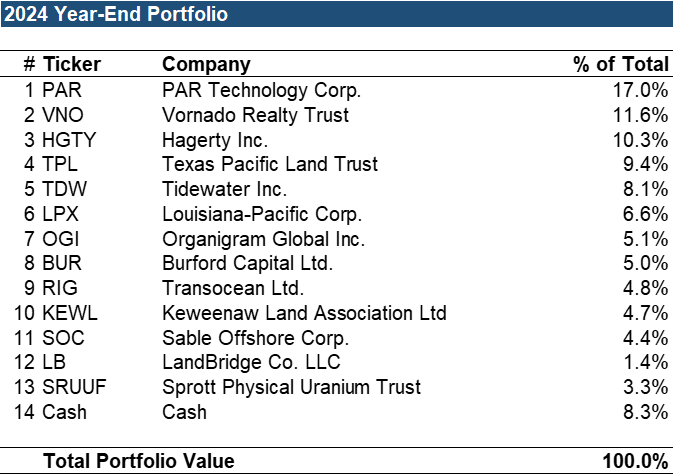

In 2024, the portfolio delivered a strong 27.6% return, with four of the top five positions driving the majority of the gains. Leading contributors included TPL (12% return contribution), PAR (7.4%), VNO (4.2%), HGTY (3.2%), while the biggest detractors included my investments in offshore oil, RIG (-1.8% return contribution) and TDW (-1.0%), BUR (-1.4%), and SRUUF (-1.0%). By year-end, my portfolio’s overall exposure to energy decreased to just over 30%.

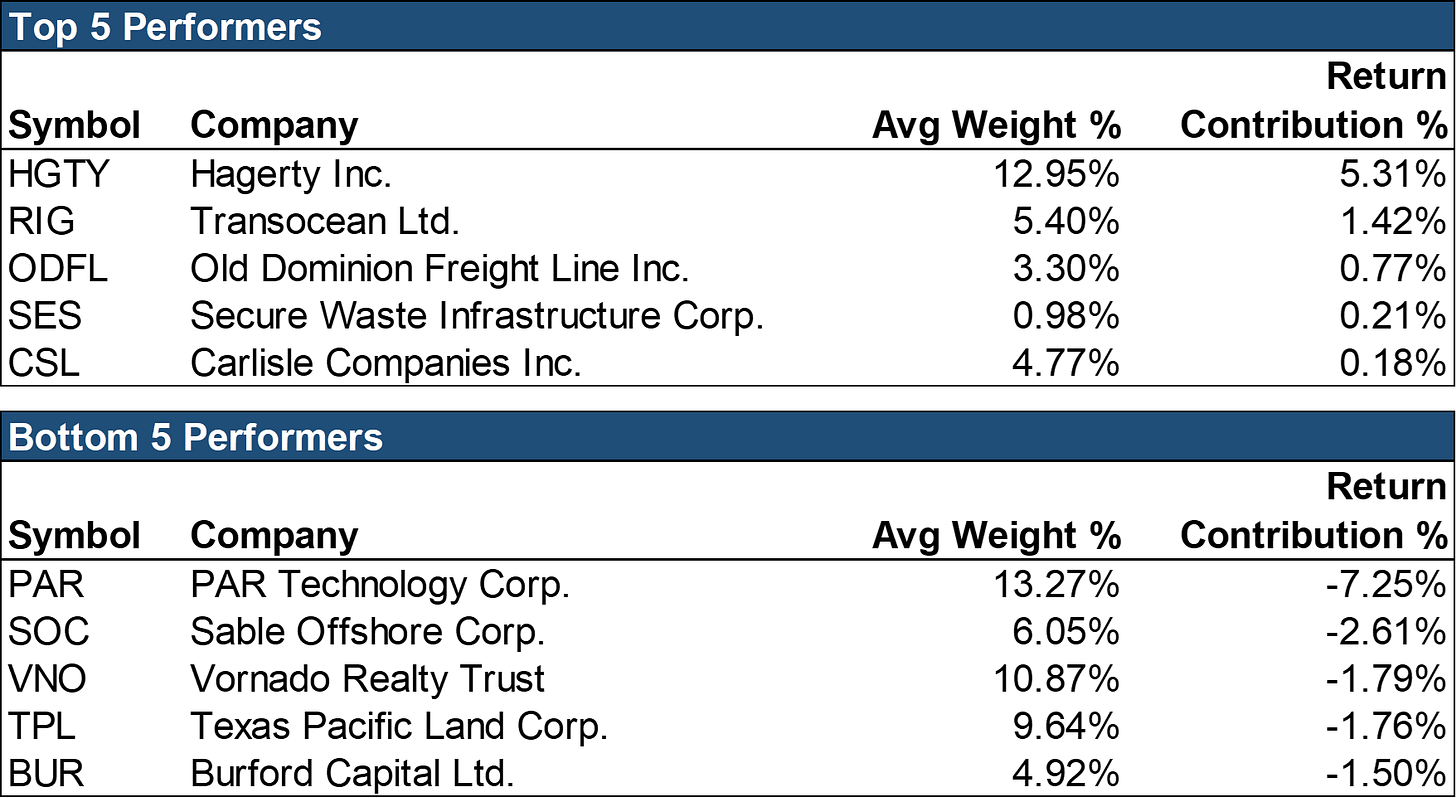

Over the past year, like a game of musical chairs, some of 2024’s top performers became 2025’s bottom performers. PAR, TPL, and VNO declined 49%, 27%, and 21% respectively, while Hagerty proved resilient, appreciating 36% over the year. Here were the top and bottom 5 performers in 2025:

I want to briefly revisit PAR, which was by far the largest drag on portfolio performance this year. As a reminder, PAR is the leading provider of point-of-sale (POS) hardware and integrated cloud-based software solutions for enterprise restaurants and convenience stores (C-stores). The company offers a complete, unified tech stack for its customers: POS system hardware and software, customer engagement and loyalty, digital ordering and delivery, back office operational intelligence, and payment processing. Its solutions are mission-critical: restaurants cannot operate without a reliable system of record and fully integrated software to coordinate data and operations across an increasingly complex ecosystem of customer and labor touchpoints spanning online, mobile, in-store, and delivery channels.

There have been a few key drivers for PAR’s decline in the past year. First, software SaaS companies at large have seen multiples compress significantly in the wake of AI. Per data from Altimeter Capital, EV/NTM Revenue multiples for medium growth companies declined from 10.6x at the start of the year to 7.7x by year-end, a 27% decrease. The sell-off has been brutal across the board - even Constellation Software hasn’t been spared, declining by almost 40% from its 52-week high. While the winners and losers of AI get sorted, Mr. Market has gone ahead and rerated software companies until proven otherwise.

Secondly, PAR’s growth rate has decelerated somewhat from 20%+ to mid-teens range. According to Scott Miller of Greenhaven Road Capital, there were three key factors to the deceleration:

Inspire Brands choosing not to switch in 2025 despite PAR winning the RFP processes (3-5% impact)

Burger King’s pause in implementations earlier in the year to add PAR’s back-office product, which increased the contract value by over 25% (1-2% impact)

PAR’s decision to delay implementations of already signed contracts for TASK, PAR’s international offering (1-2% impact)

Thirdly, overall restaurant traffic was down in 2025. Due to higher inflation and weaker consumer confidence, restaurants have continued to lose wallet share to convenience stores and grocery stores. And once you add on tariffs, elevated interest rates, and general economic uncertainty, it’s no wonder restaurants have paused on significant technology system overhauls in favor of a wait-and-see approach.

As a result, despite a robust revenue pipeline, including a >90% probability of winning at least one Tier 1 customer in 2026 and 2027, and improving profitability (margins will revert in 2026 and tariff-related price increases flow through), PAR saw its EV/NTM revenue multiple compress from 7x to 3.6x, a 49% decline - which closely tracked the decline in its stock price.

All that said, I’m not too concerned about PAR’s underlying fundamentals. The thesis remains intact. The company still has the best products in the market, a hungry, laser-focused management team, a strong culture, and a very long runway for continued share gains. Business progress rarely follows a straight line up and to the right, and fortunately neither do corresponding stock prices - which creates incredible opportunities for public market investors. I like the risk-reward from current levels and will look to add opportunistically over time.

The other position I wanted to briefly discuss is Sable Offshore (SOC). Unlike PAR, which was merely a temporary loss of capital, SOC proved to be a large permanent loss of capital, dragging the year’s overall return down by 2.6%. The truth is I should have never invested in SOC - not because it turned out to be a poor outcome, but because I didn’t follow good process.

For the uninitiated, SOC is a California-focused offshore oil and gas company looking to restart operations off the coast of Santa Barbara in the highly productive Santa Ynez field. The company went public through a SPAC led by Jim Flores, a successful oil and gas entrepreneur who had built and sold Plains Exploration and Production, which had a strong track record of operating offshore platforms. As part of the SPAC agreement, Exxon sold its offshore asset in California - which was shut down in 2015 due to an oil spill and had been mired in a legal battle with Santa Barbara County for the better part of a decade - to SOC and struck an agreement wherein SOC would have two years to find a way to restart the operations or be forced to return the asset to Exxon.

At first glance, there was a lot to like about SOC. The company had a highly aligned management team - Jim Flores and his family invested $33 million out of pocket into the deal and on a fully diluted basis, owned ~20% of the company; the underlying asset had a long history of profitable operations and, if successfully restarted, had the potential to generate 30-50%+ free cash flow yields within a few years depending on the price of oil and level of production; and the regulatory issues seemed surmountable. And to top it off, Li Lu made it a 1.3% position of his portfolio in Himalaya Capital. If it was good enough for Li Lu, surely it was good enough for me... right?

Well, as it turned out, the regulatory issues proved to be insurmountable. The State of California found a way to effectively block the restart of the pipeline operations for the oil platforms, causing the stock to tank by over 50% between September and October 2025. Unfortunately, despite sitting on significant gains earlier in the year, I was caught off guard by the negative developments and decided to exit the position at a 39% loss.

I learned many important lessons with SOC, one of which is to never invest in companies you don’t fully understand. SOC was a good reminder of the pitfalls of coattail investing. While there’s nothing inherently problematic with sourcing ideas from other investors, it’s absolutely crucial to do your own work. If you don’t have a good grip on the key drivers, risks, and range of potential outcomes, it’s difficult to size positions and adjust probabilities as new information comes in. In the case of SOC, while I understood the broad strokes of the thesis, I didn’t fully grasp the legal and regulatory issues well enough to be able to actively track the thesis. And to compound the mistake even further, I sized the position far too aggressively at ~5% of total value. I grew complacent and ultimately paid the price.

While PAR and SOC weighed on results, one standout bright spot has been Hagerty Inc. (HGTY). I wrote at length about Hagerty in a previous post, so I won’t rehash the whole thesis here, but at a high level, 2025 marked a significant inflection year for the company. State Farm policies have begun rolling over (with ~25-27 states expected online by year-end), the new Enthusiast Plus program has launched in Colorado (with more states to come over time), and Hagerty’s quota share with Markel will increase from 80% to 100% in the US beginning in January 2026. In addition, Hagerty added three new prestigious live auction events to the calendar in 2025, which drove 115% growth in Marketplace revenue.

Year-to-date, revenues are up 18% while operating profit has surged 78% due to operating leverage. With the State Farm rollout and Enthusiast Plus now in full force, along with ongoing efficiency initiatives such as the Duck Creek IT implementation, there’s a clear path for earnings to grow ~5x over the next four years, implying high single-digit P/E multiples a few years out. As Buffett says, “Time is the friend of a wonderful business and the enemy of the mediocre.” I don’t see myself selling anytime soon.

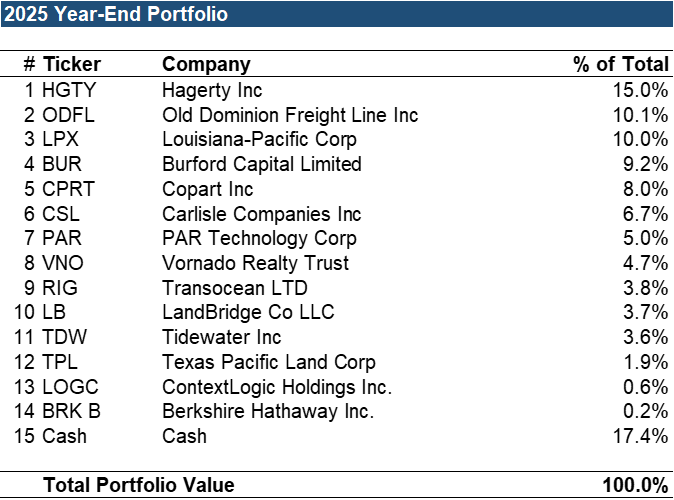

Looking ahead, here’s how my portfolio is positioned going into this year, at cost:

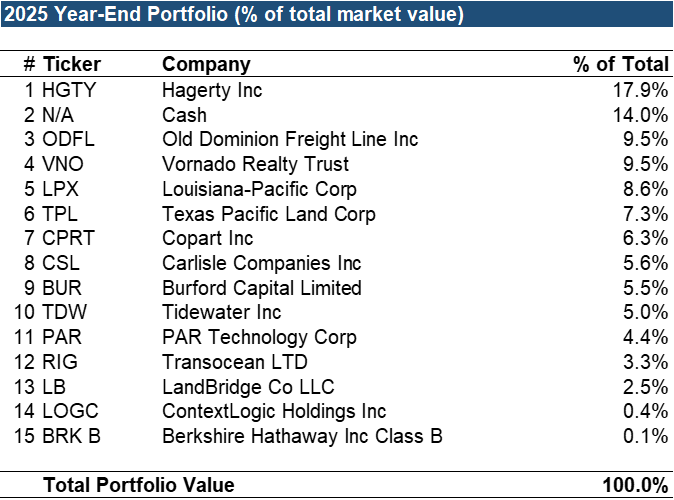

And at market:

When it comes to position sizing, I generally focus on portfolio cost rather than market values, as I don’t think it makes sense to sell positions just because prices have exceeded certain arbitrary thresholds. Instead, position sizes should be determined based on an assessment of underlying risk-reward, prospective IRR, and the probability of permanent loss.

As you’ll note, there are several new core positions this year - Old Dominion Freight Line (ODFL), Copart (CPRT), Carlisle Companies (CSL) - all companies I’ve researched extensively during my time at Columbia. I haven’t written up ODFL and Copart on this blog yet, but if you’re interested in learning more about CSL, here are a few resources my team (which won the Pershing Square Challenge this past year pitching CSL) has shared in the public domain:

The biggest philosophical change I’ve had this year, which drove portfolio decisions, has been my deliberate shift towards higher-quality businesses - those that are competitively advantaged, earn strong returns on capital, are conservatively leveraged and supported by favorable long-term secular tailwinds, and are run by aligned, honest, and skillful management teams. Given the current frothy market environment and significant economic (and geopolitical) uncertainty, I’ve been thinking a lot about how to best position the portfolio over the next 5-10 years to earn a reasonable rate of return while avoiding undue risks of permanent loss.

If there’s one thing I’ve learned over the past five years, it’s that I have no ability to predict future commodity prices. Many years ago, I believed that we would see structurally higher oil prices as a result of years of underinvestment and lower well inventory. Yet since then, oil prices have declined about 30%. Fortunately, my oil-related investments have worked out reasonably well, and I still like the potential risk-reward, particularly in offshore, but I’ve reduced position sizes significantly to reflect my cautious outlook.

My “humble” goal is to compound capital at 15-20% per year over the long-term. This is, of course, no small feat when you consider that the S&P 500 has averaged a total return of ~10% since 1928 — ~6% from price appreciation and 4% from dividends — and that ~85-90% of active equity fund managers underperformed their index over the past 10 years. But fortunately for me, as an individual investor, I’m less constrained by restrictive institutional mandates, large AUM, and reputational concerns, which hopefully gives me an advantage to outperform over time.

As always, only time will tell.

Strong work!

very thoughtful reflections. keen to continue reading about your journey!